How Section 179 Can Unlock Savings for Your Practice

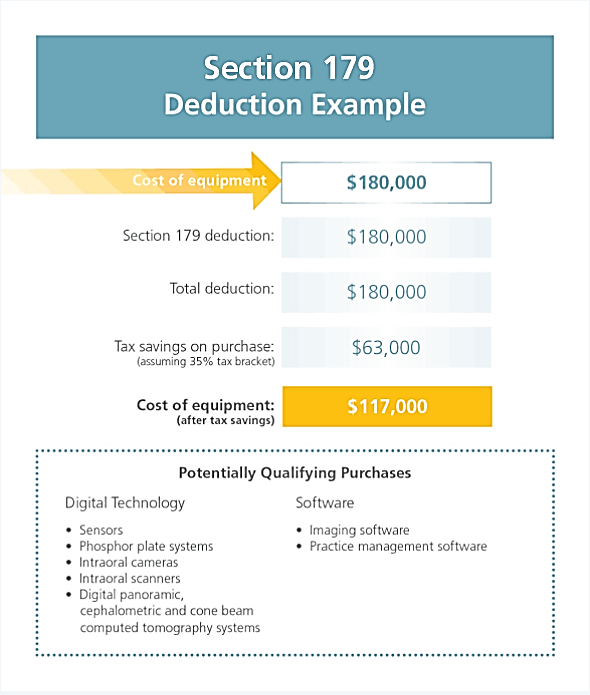

Over time, imaging systems can pay for themselves thanks to improved communication and case acceptance. However, if you decide to invest now, you could have a potential accelerated tax benefit.* With Section 179 of the IRS tax code, your practice could save a third of the cost on capital equipment. Section 179 is designed to spur economic growth by giving small business owners a financial incentive to invest in their business. For 2019, you can deduct the full price of qualifying equipment and/or software purchased from this year up to $1,020,000.

Panoramic and CBCT imaging systems, intraoral sensors and CAD/CAM are just a few examples of innovative digital technology that could directly benefit your patients. Incorporating new technology for a digital workflow allows clinicians to save time and money without sacrificing a high-quality outcome. Since Section 179 applies to outright purchases and financed equipment, businesses can choose to deduct the full cost of the equipment in one year.

Here’s one possible way you could save with Section 179:

Although the deduction limit for Section 179 is $1,020,000, the total limit on equipment purchases caps at $2.55 million, making this a true small business deduction. Just remember that the equipment and software must be financed and in place by midnight December 31, 2019 to qualify for 2019 expensing under Section 179 or bonus depreciation.

For more information about Section 179, Consult IRS Publication 946 or https://www.irs.gov/publications/p946/

In addition, if your purchases exceed the limits for Section 179, you can depreciate 100 percent of the cost of eligible equipment acquired and put in service during 2019, 2020, 2021 and 2022 in the first year. After that, bonus depreciation is scheduled to phase down to 80% in 2023, to 60% in 2024, 40% in 2025, and 20% in 2026.

Section 179 can be a great tax benefit for practices looking to offset the cost of equipment. Taking advantage of this deduction could be the start that your practice needs for 2020.

*Before making any major purchase decisions please speak to your business accountant or tax advisor regarding your personal facts and the impact on your income tax filings. This document was not intended or written to be used, and it cannot be used for the purpose of avoiding U.S. federal, state or local tax penalties.